el producto #395 🚀

Uber self-driving EVs, GTM tactics, When to join a startup, Apple Intelligence beta and launch dates, OpenAI advanced voice mode, The Product Analytics market & more

Hi folks 👋

Happy weekend and welcome to a new edition of el producto!

🎰 The week in figures

$80B: Cloud infrastructure revenue approached $80 billion this quarter, with AI propelling the market forward

$5B: OpenAI is set to lose up to $5B in 2024, based on undisclosed financial data and insider info. The report also notes that OpenAI may need more funding within 12 months to stay afloat

$200M: London-based women’s health app provider Flo Health cemented its unicorn status, crossing the $1B valuation mark at its $200M Series C. This milestone makes Flo the first purely digital consumer women's health app to achieve unicorn status

30%: By the end of 2025, Gartner predicts that 30% of generative AI projects will be abandoned due to unclear business value, poor data, high costs, or lack of risk controls

💸 Q2 results

Amazon: Q2 retail sales growth slowed, with online store sales up 4.6% to $55.4B and physical store sales up 3.6% to $5.2B. Ad revenue grew 19.5% to $12.8B, subscription revenue increased 9.8% to $10.9B, and third-party seller services rose 12% to $36.2B. AWS's net income doubled YoY to $13.5B, driven by increased AI use and faster cloud adoption. Amazon is contemplating a direct-from-China marketplace to rival budget competitors, but this could alienate non-Chinese sellers and clutter the site

Meta reported strong earnings that beat estimates and provided an optimistic Q3 forecast. Revenue for Q2 grew 22% to $32B, with net income soaring 73% to $13.47B, driven by a 22% increase in ad revenue from Facebook and Instagram. The company anticipates Q3 revenue of $38.5-$41B, above the expected $39.1B. Meta's cost-cutting measures, including 21,000 job cuts since 2022, boosted operating income by 58% to $14.9B, with margins expanding to 38%, despite expenses including a $1.4B facial recognition lawsuit settlement

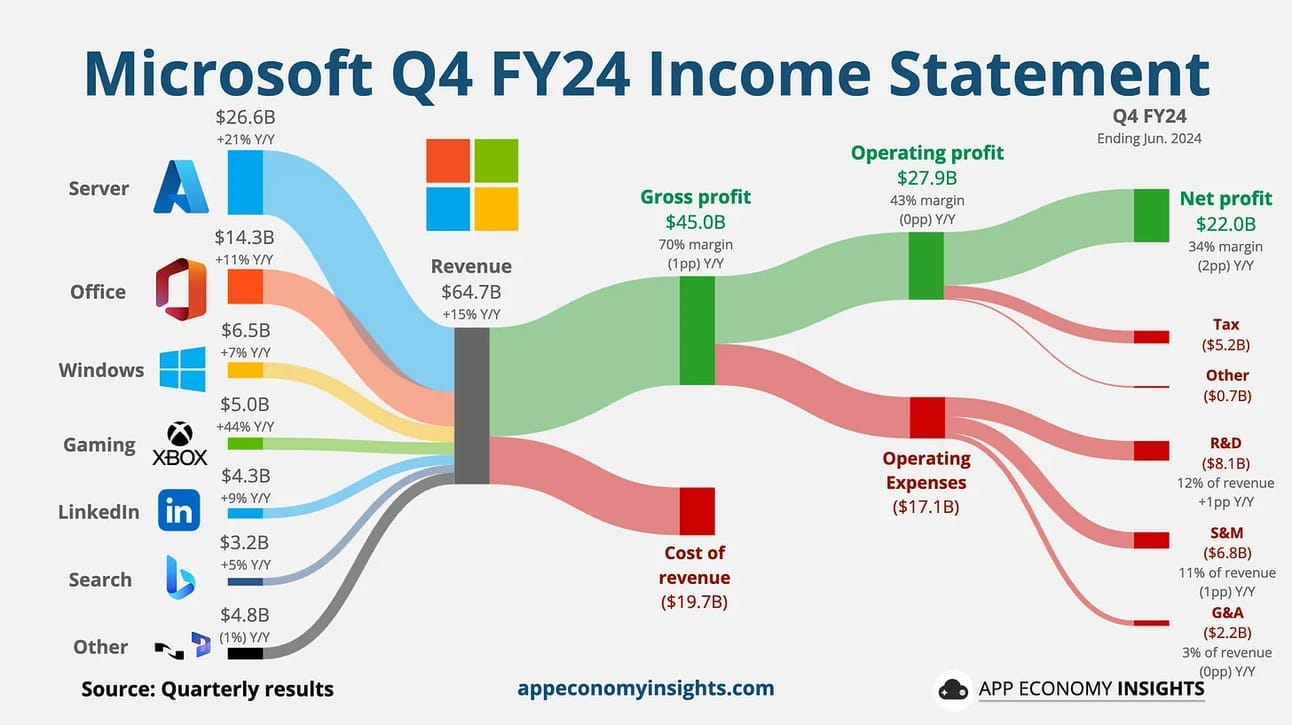

Microsoft reported strong earnings and revenue, with a 15% YoY increase in revenue and net income reaching $22.04B. Despite these positive figures, investor focus shifted to the slightly disappointing cloud results. The company's Intelligent Cloud segment generated $28.52B, missing the $28.68B analyst consensus, and Azure's 29% growth fell short of expectations. However, Azure's growth was bolstered by AI services, contributing 8pp. Executives are optimistic about a cloud growth boost in 2025, critical as Microsoft competes with AWS and Google in the AI workload sector

PayPal reported impressive financial and operational metrics, including a total transaction volume of $403.9B, a 11% increase YoY. Net revenues rose by 8%, reaching $7.9B. Operating Income increased by 17% to $1.325B, with an operating margin of 16.8%, up by 1.26%. Net income rose by 10% to $1.128B. Active accounts remained steady at 429M. Number of transactions increased by 8% to 6.58B. Total Payment Volume (TPV) grew by 11% to $416.8B, with U.S. TPV rising by 11% to $265.5B and International TPV by 10% to $151.3B. Venmo, PayPal’s popular mobile payment service, processed over $73B in total payment volume, marking an 8% increase YoY. Venmo’s MAU grew by 5%, reaching nearly 62M

📰 What’s going on

Apple’s AI features, branded as "Apple Intelligence," will launch in October with iOS 18.1, missing the September rollout of iOS 18 and the iPhone 16. The free AI suite will be available starting this fall only on iPhone 15 Pro models and newer, as well as on Macs and iPads with the M1 chip or newer. Apple released the first version of Apple Intelligence to developers via the iOS 18.1 beta on Monday

OpenAI has rolled out its Advanced Voice Mode with conversational AI capabilities to a select group of ChatGPT Plus users

Uber has partnered with Chinese EV maker BYD to roll out 100k self-driving EVs in the EU, LATAM and other nations (but not the U.S.)

Reddit has acquired Memorable AI, its first acquisition since going public in March, to enhance ad quality on its platform. Memorable AI, specializing in AI-driven ad creation and optimization, will help Reddit improve ad text, images, and videos

Canva has acquired generative AI startup Leonardo.ai to expand its AI technology stack, with the deal involving both cash and stock. All 120 employees of Leonardo.ai, including the executive team, will join Canva. Leonardo.ai, which was founded in 2022 and originally focused on video game asset creation, will continue to operate independently. This acquisition aims to enhance Canva's Magic Studio suite with Leonardo.ai's technology, which includes tools for image creation and AI model development

Airtable completed the acquihire of Dopt, a startup specializing in product onboarding experiences. The acquisition, which closed in late June, is primarily about acquiring Dopt's AI-based assistance tools and talent. Dopt's team will join Airtable's AI division, with their service shutting down on August 15

CrowdStrike has been sued by its shareholders claiming it defrauded them by concealing the risks created by its inadequate software testing that lead to the outage that crashed over 8 million computers

📚 Good reads

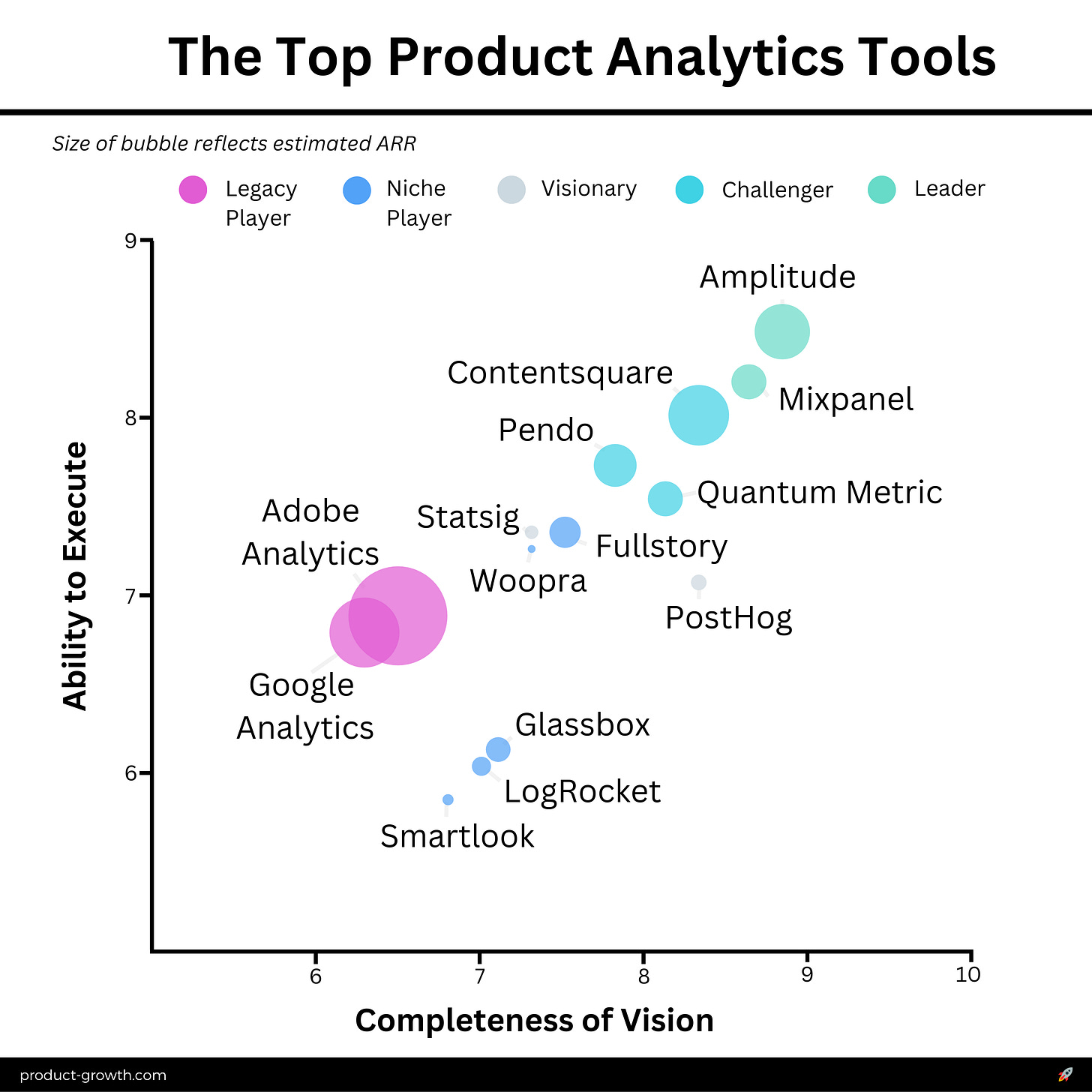

The Product Analytics market:. Aakash Gupta shares a useful overview and deep dive of the space, including interviews with Product leaders at the 4 biggest players, market map, & magic quadrants. An extremely useful article (that I have already bookmarked) if you are considering to upgrade your analytics stack

Is the classic homepage out, and is immediate, ungated, andinteractive value in? Leah Tharin argues that for PLG companies, ungated tools or interactive demos can be a more valuable first experience in getting people to try your product and share their email. Homepages are often just business cards telling people what you do, but as Leah noted, people are often landing on a page with more intent after learning about a product elsewhere. The best example of giving users the value they want over telling them what you do is Google. Imagine Google told you about itself first, and then you had to click a button to go search for something. That would be an awful experience

Use boring sign-up screens - learnings from Spotify, Nextdoor, Ring and AllTrails sign-up screen redesigns, by Ali Abouelatta. When it comes to sign-up screens, there is often a tradeoff between functionality and delight. Fortunately, these are the easiest parts of a flow to test and get confident data on given the volume of traffic they get. And, the data shows that basic and boring screens outperform the pretty and playful ones

Are you being too detailed in the wrong ways, and not detailed enough in the right ways? Wes Kao argues that details aren’t the problem. The problem is too many of the wrong details. The wrong details slow you down and create confusion. The right details advance the conversation, create a deeper understanding, and lead to more productive discussions.However, sharing the right amount of detail takes an enormous amount of real-time judgment. Pro tip from Wes: “If you think your audience might think you’re being too detailed, mention why those details are important to include.” Wes shares 5 real-life examples, so you can watch out for this in your own work

Levels of thinking: how to make better decisions with second-level thinking. Another great article by Anne-Laure Le Cunff to help you understand how our brain handles decisions, and to improve your decision-making

When to join a startup. Dan Hockenmaier breaks down and explores the different risks you can face when joining a startup. Learning to assess risk will help you maximize the economic outcome

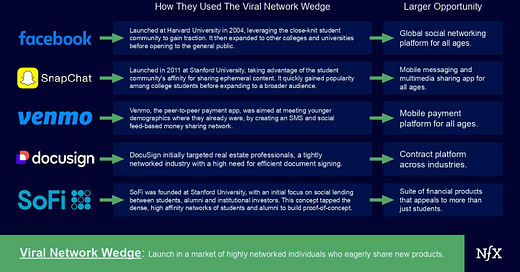

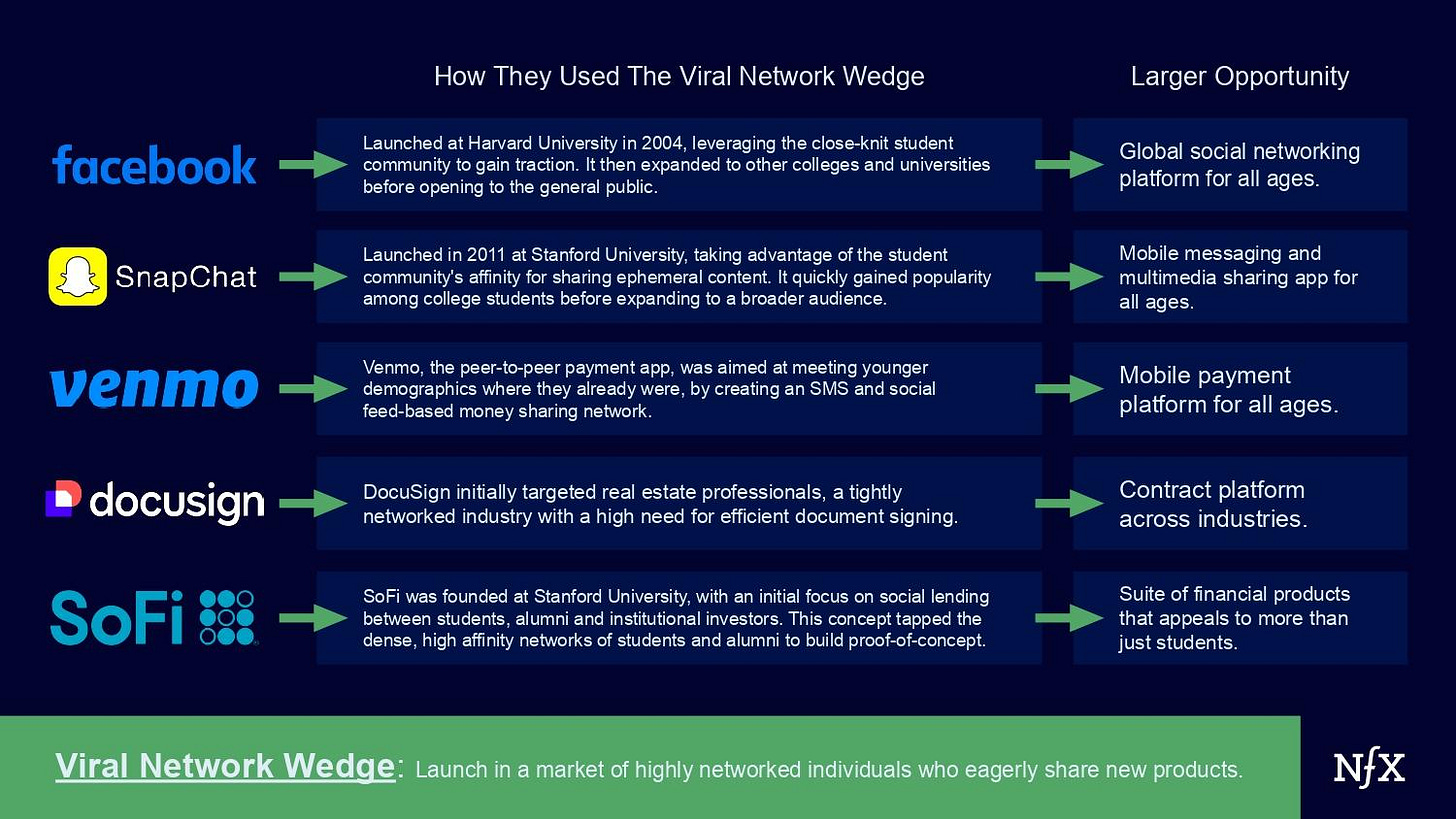

12 killer wedges for your company’s growth. Peter Flint gives tips on getting to the market niche by niche. These go-to-market tactics are essential for platforms and ecosystems, making this article a valuable resource you'll likely revisit often

That’s all for this week. As usual, feel free to reach out and share your thoughts by replying back to this email or commenting on Substack

Thanks for your support!

Angel