el producto #355 🚀

Big tech Q3 results, Passwordless Amazon, Apple Pay Later, AI-first marketplaces, The science of brainstorming, How Tinder designs product and why, & more

Hey team,

Happy weekend and welcome to a new edition of el producto

🎰 The week in figures

$1B: Apple was caught by surprise as tools like ChatGPT rocketed to popularity this year and is on pace to spend ~$1B/year to add generative AI tools across its suite of products

$500M: Generative AI search engine Perplexity is reportedly closing an investment round that would value it at approximately $500M. The company had a post-money valuation of $150M in March

$500M: Google will invest another $500M into Anthropic with the ability to invest up to $1.5B more after its initial $550M investment earlier this year

181M: Amazon has over 181M users in the EU. The e-commerce giant was forced to disclose the figures by the EU Digital Services Act (DSA)

$167M: Employment Hero, an Australian recruitment, HR and payroll platform, secured an AUD $263 million ($167 million) Series F

$100M: Databricks will acquire Arcion, an enterprise data consolidation platform, for ~$100M; in September, Databricks raised $500M at a ~$43B valuation

$100M: Island, a Dallas-based startup building an enterprise browser solution, raised a $100M Series C at a $1.5B valuation led by Prysm; the company has sold 2M+ browsers to 100+ customers so far

100M: Meta's Threads, the Twitter competitor, has reached nearly 100M MAU, according to CEO Mark Zuckerberg, who aims to reach 1B users “in the next few years”

💰 Q3 results

Alphabet: revenue: $76.7B (+11% y/y), net income: $19.7B (+41% y/y), YouTube ad revenue: ~$8B (+12.5% y/y), Cloud revenue: ~$8.4B (+22.5% y/y), shares were down 8% due to cloud miss

Amazon: revenue: $143.1B (+13% y/y), net income: $9.9B (+244% y/y), AWS revenue: $23.1B (+12% y/y), ad revenue: $12.1B (+26% y/y); shares were up 6%+ on the news

Meta: revenue: $34.15B (+23% y/y), net income: $11.58B (+164% y/y), headcount: 66.2K (-24% y/y), family DAP: 3.14B (+7% y/y); shares were down slightly on the news

Microsoft: revenue: $56.5B (+13% y/y), net income: $22.3B (up 27% y/y), Azure revenue was up 29% y/y; shares were up ~3% on cloud beat

Spotify: revenue: €3.4B (+11% y/y), net income: €65M, FCF: €216M, paid subs: 226M (+16% y/y); shares were up 8% initially, then dropped 5%

Snap: revenue: $1.19B (+5% y/y), net loss: $368M, DAUs: 406M (+12% y/y); shares were down 5% after initially jumping 20%

📰 What’s going on

Instagram is testing a verified-only toggle, which would allow users only to view posts from users paying for a Meta Verified subscription

WhatsApp is testing a new self-destructing voice messages feature which automatically deletes messages after a set period. The feature is designed to help boost privacy

Mark Zuckerberg says AI will be the company's top investment focus in 2024, with plans to boost computing resources and hire more engineers

YouTube is in ongoing negotiations with record labels over its AI tool, which lets creators use the voices of famous musicians, the result of which will be the first significant deal of its kind in the music industry

Amazon plans to launch passkey support for shopping apps and browsers. The firm is aiming for a "passwordless internet," according to Amazon's senior vice president of e-commerce, Dave Treadwell. The passkey system will allow users to unlock their Amazon accounts using their faces, fingerprints, or PIN codes

Amazon told its managers they can fire staff who fail to comply with the firm's return-to-office policy. The policy requires employees to work from Amazon's physical offices for at least three days per week

Apple is gearing up for a Mac-focused product launch, with a possible unveiling of a new 24-inch iMac to be announced on October 30th

Apple Pay Later appears to have officially launched for all qualifying U.S. residents. The feature had been available on an invite-only "early access" basis since March

Google Meet has added a new filter to its video calling tool designed to help users subtly enhance their appearance. The new features include under eye lighting and smoothing. Google says the features have been highly requested by users to help them boost their confidence

LinkedIn is rolling out its new “Top Job” option to all LinkedIn Premium subscribers, which enables LinkedIn subscribers to mark three roles per month as a “Top Choice”, which alerts recruiters to their extra interest in the role

Elon Musk wants to turn X into a financial hub to replace banks by the end of 2024. Musk shared the idea Thursday during an all-hands call with employees. "So, it’s not just like send $20 to my friend," Musk said. "I’m talking about, like, you won’t need a bank account." X is seeking money transmission licenses across the U.S., with licenses already obtained in nine states

Cruise has paused all driverless operations after the CA DMV suspended its robotaxi permits earlier this week

Uber started offering Phoenix area riders the option to choose fully independent Waymo cars. Customers can choose to accept or reject the autonomous option, and there is a 24/7 helpline for passengers who are traveling in a Waymo car

📚 Good reads

Is AI going to be the next Over The Top (OTT) layer? Great piece by Sanget Choudary, exploring the directionality of the evolution of the AI: a “sort of Zapier-like layer but for AI”. We’re wondering who's well positioned to play the Over The Top role that WeChat played, any of the big tech? WeChat won by creating network effects first, then adding payments further expanding in integrations space to drive up the ARPU and get almost non displaceable as embedded in hundreds of workflows. What lessons can we learn and how can we expect this pattern to play out given the current AI landscape?

The AI-first marketplace. Nfx’s Pete Flint shares his thoughts on the impact of GenAI (and AI in general) on marketplaces. The article focuses on enhancements and positive impacts & doesn't cover much of the drawbacks such as the risk of OTT disintermediation from large digital incumbents, but it's a great start for PMs and founders looking for the directions along which to integrate AI

Reforge Artifacts is out of Beta. You can now access a whole lot of product management, growth, marketing (and more) related artifacts and examples coming from some of the digital leaders on the market

The science of Brainstorming - how to effectively generate new ideas, by Anne-Laure Le Cunff. “Creativity is innate in the sense that we are all born with it. But, as we grow up, most of us slowly unlearn it. The good news is that what is unlearned can be learned again. It’s just a matter of figuring out how“

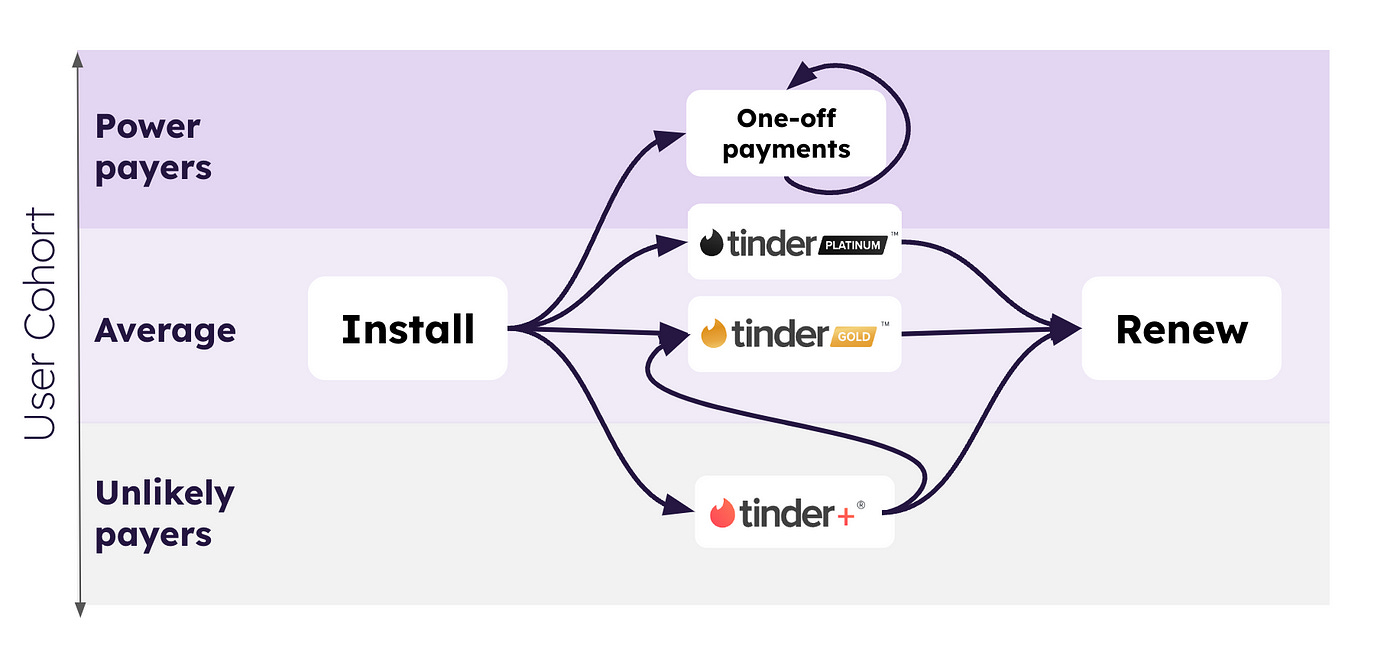

How Tinder designs product (and why) - the playbook for designing growth of $1.6B in revenue, by Felix Lee. A great exploration of Tinder’s early UX flow (activation over monetization), the power of personalization, and how to leverage super users

That’s all for this week! Let me know what you think by replying back to this email or commenting on Substack

Angel