el producto #318 🚀

Apple's BNPL and higher-end iPhones, Google and Microsoft AI push (+ the major Chinese tech players), Shopify's blockchain tools, The startup winter, Q4 financials, more

Hey team,

Welcome to a new edition of el producto

🎰 The week in figures

$100M: Jobber, an Edmonton-based startup that provides an ops management platform for home service businesses, raised a $100M Series D; the company has >$100M in ARR and serves 200K businesses in 60 countries

-$5.9B: SoftBank reported a $5.9B loss for its Vision Fund last quarter, its fourth consecutive period with a loss; SoftBank invested <$350M in startups in the quarter, down ~95% off of its average of $6B/quarter over the prior 5.5 years

0.2%: Twitter had 180,000 paid subscribers in the U.S. as of mid-January, representing only 0.2% of its monthly active users in the country, according to a leaked internal document; 62% of paid Twitter subscribers reside in the U.S.

-4%: eBay will cut 4% of staff, impacting 500 employees, to increase capital for investments in new technologies

-7%: GitLab will cut 7% of its staff (114 employees), citing a challenging macroeconomic environment

-10%: Microsoft-owned GitHub will cut 10% of its staff (~300 employees), close its offices and shift to fully remote as part of broader cost-cutting measures

-15%: Zoom said it plans to lay off 1,300 employees, equating to about 15% of its workforce

-20%: Yahoo announced a 20% RIF and will cut 50% of its ad tech roles, impacting ~1600 employees

💰 Q4 results

Disney: revenue: $23.5B (+8% y/y), net income: $1.36B, FCF: -$2.15B; Disney+ reported a loss of 2.4M subscribers, its first decline since launching in 2019; parks and experiences revenue was up 21% y/y to $8.1B; Disney also announced it would be slashing 7000 jobs (~3% of employees) to cut ~$5.5B in costs and will restructure the company into three divisions focused on entertainment, parks, and ESPN; shares were up ~2% on the news

Pinterest: revenue $877.2M (+4% y/y), net income: $17.5M (-90% y/y), global MAUs: 450M (+4% y/y), shares were down 4% after missing on revenue

Robinhood: revenue: $380M (+5% y/y), transaction-based revenue: $186M (-11% y/y), net loss: -$166M, MAUs decreased by 800K to 11.4M, ARPU increased to $66 from $63; shares were down ~3% on the news

Uber: revenue: $8.6B (+49% y/y), gross bookings: $30.7B (+19% y/y), net income: $595M ($756M from net unrealized investment gains), FCF: -$303M; stock was up over 2% after the company beat top and bottom line estimates

📰 What’s going on

Apple has opened up its buy now, pay later feature to retail employees for testing, suggesting that the company could release it to the public very soon; the "Apple Pay Later" feature will allow users to split their Apple Pay purchases into four equal payments over six weeks, without interest or fees

Apple is considering releasing a more expensive, higher-end iPhone model with faster processing and an upgraded camera; Apple made a similar move by releasing the "Apple Watch Ultra" last year

Microsoft unveiled Bing's new GPT-integrated search engine, which runs on a new LLM called Prometheus to improve relevancy, annotate answers and give more recent results; Microsoft also enhanced its Edge browser with AI capabilities, including a sidebar with AI text-generating capabilities

Microsoft is preparing to demo how it will integrate OpenAI technology and its new Prometheus Model into Word, PowerPoint, and Outlook in the coming weeks; CEO Satya Nadella is pushing hard for AI launches

During a live event on Wednesday, Google demonstrated the latest AI upgrades to its search engine, Maps, and more; a Google executive briefly showed off the tech giant's recently unveiled Bard chatbot; during Google's announcement of Bard, a gif demonstrating the chatbot's capabilities included inaccurate information; shares were down over 8% after

Twitter Blue subscribers can now compose tweets with up to 4000 characters; on initial viewing, users will only see 240 characters of a tweet but can tap “show more” to keep reading

Twitter’s API will remain free until February 13, after which Twitter will charge $100/month to offer users low-level usage of its API as well as access to its ads API

TripActions, a business travel management startup, has rebranded as Navan and will consolidate its travel, corporate card, and expense services into a single app; the company will also utilize ChatGPT to learn customers' preferred vendors and incorporate them into proposed itineraries

Meta is planning to revamp its Horizon Worlds metaverse app with a focus on teen and young-adult users; the revamped app could be launched as early as March

Meta plans to release its next consumer headset in late 2023, according to Mark Zuckerberg; the CEO said the headset, likely called the Quest 3, will feature full-color mixed reality

Shopify launched a suite of blockchain commerce tools such as loyalty tokens, NFTs, and crypto wallet payments

Shopify launched an update with new code-free functions, like loyalty memberships, add-ons, and ID verifications; the update also lets users check out on just one page

Revolut has launched a donations page on its app for users to support victims of recent earthquakes in Turkey and Syria; Fintech continues to prove itself a force for good in times of crisis, as has been seen during other world events like the war in Ukraine

Revolut launched crypto staking functionality to customers in the UK and Europe

Clay Bavor, Google’s head of AR and VR, is leaving the company to co-found a new startup with former Salesforce Co-CEO Bret Taylor

Alibaba announced it is developing an AI chatbot similar to ChatGPT, and Baidu announced it is wrapping up internal testing of its own AI chatbot, called Ernie; JD.com has also shared plans to launch a similar product

📚 Good reads

How to ethically use scarcity to drive sales. Using scarcity to convince users can quickly backfire; but Uber Eats has an interesting way to use it. Check it out on this visual case-study by Growth.Design

Leah's Product Market Fit Guide: How to find it, product-led. Leah Tharin has been publishing amazing content in the last few months. After her successful PLG guide, now she shares an extensive and actionable PMF piece

How long will the startup winter last? VC Braggs makes a good analysis of the current market slowdown, comparing it to previous crises, highlighting differences, and showing some positive signs

Why you should send a weekly summary email. A deceptively simple productivity and management tool. An alternative (that I often use) is shared google doc / word with your team or manager

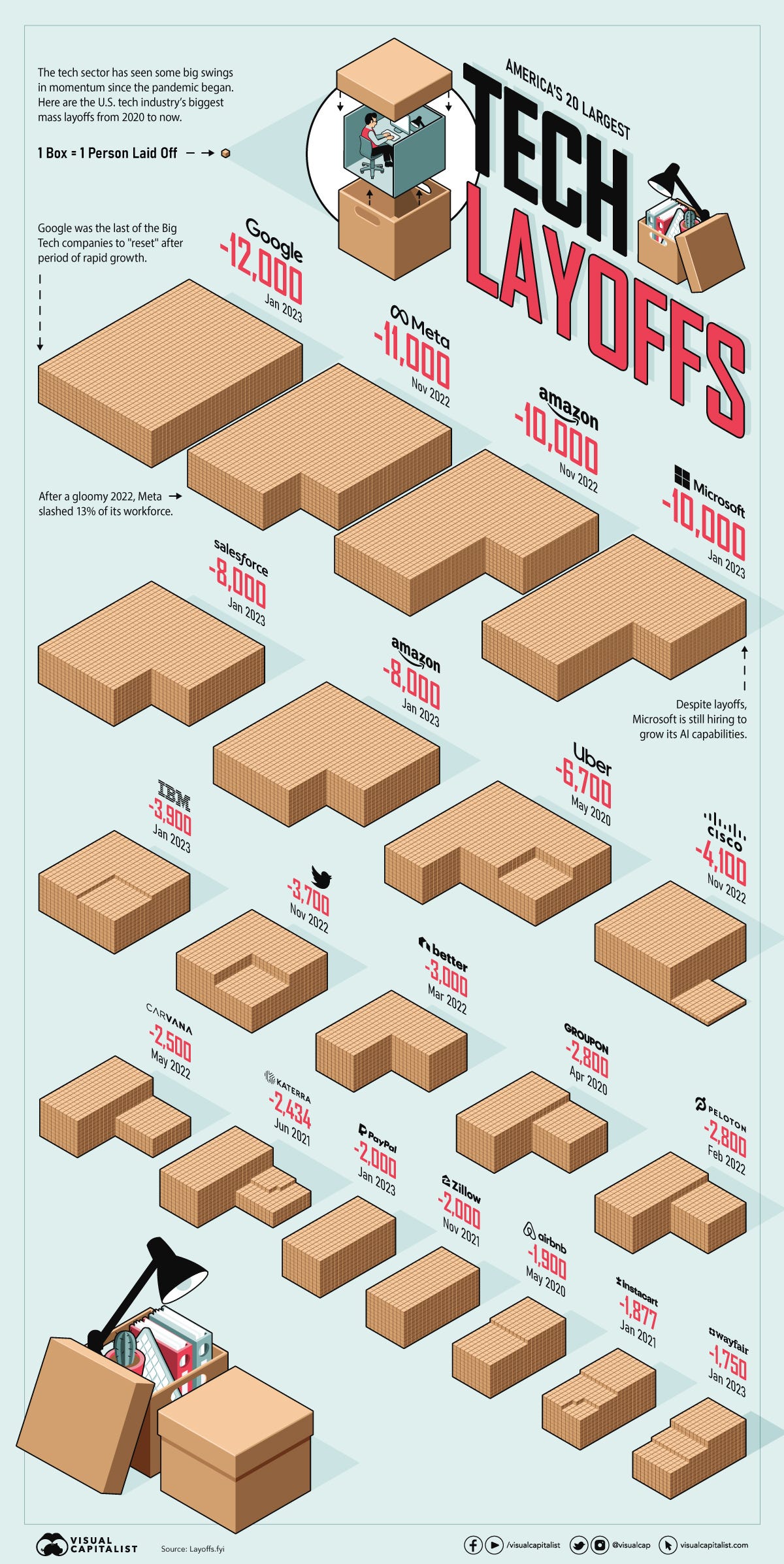

Visualizing the biggest US tech layoffs since 2020:

🚀 Emerging trends

A step-by-step guide to building a GPT-3-based AI chatbot, by Dan Shipper

OpenAI vs Google. Sarah Tavel reflects on the bull case for OpenAI’s threat to Google’s dominance, giving good context to the sudden AI push on Google’s side

That’s all for today! Let me know what you think by replying back to this email or commenting on Substack

Angel

el producto is free, but if you enjoy reading it, you can support my work and buy me a coffee 🙌