el producto #277 🚀

Q1 results, Telegram crypto payments, Musk vs Twitter (final round? not yet), Airbnb work from anywhere, Big Tech revenue breakdown, Web3 network effects & more

🎰 The week in figures

$22.1B: Huawei spent $22.1B in 2021 on research and development; the Chinese electronics company spent the highest proportion of revenues (22.4%) on R&D out of all the large global tech companies; in absolute terms, Huawei spent $2.5B less than Meta and $1B less than Apple

$580M: AI research company Anthropic raised $580M Series B; the company will use the funds to make reliable, transparent, and predictable large-scale AI systems

$412M: Code reliability company SonarSource raised $412M at a $4.7B valuation; the Geneva-based company continuously monitors code for reliability and vulnerabilities; its used by companies like Barclay’s, Alphabet, Dyson and Vmware

$300M: OneFootball, a Germany-based sports media company, raised a $300M Series D; the soccer-focused media platform will form OneFootball Labs to allow players and clubs to release digital assets and fan-centric experiences on the blockchain

$220M: Berlin-based Taxfix raised $220M Series D; the company provides a tax filing smartphone application; Taxfix entered the unicorn club with a valuation of +$1B; incoming funds will be used to add more products to its portfolio, boost platform growth, and expand its team to over 500 employees

175M: TikTok was the most downloaded app worldwide last quarter (175M), beating out Instagram; TikTok became the fifth app ever — and the only app not owned by Meta — to surpass 3.5 billion all-time downloads

$164M: UK-based Starling Bank raised £130.5M at £2.5B valuation; the challenger bank said: "This will enable us to continue our growth and to build a war chest for acquisitions. We are looking at a number of potential targets"

$130M: Video analysis startup Kinexon has raised a $130M Series A led by Thomas H. Lee Partners; the company helps sports teams and industrial companies analyze movements and provide real-time improvement suggestions; the company works with Paris Saint Germain, the Philadelphia 76ers, RedBull, BMW and more

💰 Q1 financials

Amazon Q1 2022 results: Net Revenue was $116.4B (up 7% y/y); operating income was $3.7B (down ~58.4% y/y); net loss was $3.8B compared with net income of $8.1B last year, they reported a $7.6B loss in its Rivian investment; shares traded ~12% lower on decreased Q2 revenue forecasts

Apple Q1 2022 results: Revenue was $97.28B (up ~9% y/y); net income was ~$25B (up ~5.8% y/y); CFO Luca Maestri said supply chain constraints could hurt sales by ~$8B. After reporting one of its strongest quarters in history, Apple warned that supply constraints will be "substantially larger" in the current quarter due to COVID disruptions and silicon shortages

Microsoft Q1 results: revenue was $49.4B (up 18% q/q) amid rising demand for its server and cloud services; Microsoft Azure (46% growth) and its online Office versions have insulated the software maker from ongoing supply-chain issues, CEO Satya Nadella said

Meta Q1 2022 results: revenue: $27.9B (up 7% y/y), net income: $7.4B (down 21% y/y), operating margin: 31% (down 12% y/y), total daily active people (DAP): ~2.9B (up 6% y/y), total monthly active people (MAP): ~3.6B (up 6% y/y), Q1 revenue per employee was ~$358K; stock was up ~15% Thursday morning. Meta’s Facebook Reality Labs (FRL) division lost ~$3B in Q1; FRL generated ~$695M in revenue, beating expectations of $683M; in 2021, the FRL division reported a ~$10.2B loss on revenue of $2.3B

Pinterest Q1 2022 results: revenue: $575M (up 18% y/y), net loss: $5.2M (76% better than 2021), global MAUs: 433M (down 9% y/y), global ARPU: $1.33 (up 28% y/y)

Robinhood Q1 2022 results: revenue: $299M (down 43% y/y), net loss: $392M (down from $1.4B reported last year), MAU:15.9 (-10% y/y), ARPU: $53 (-62% y/y). The company announced it would cut its full-time workforce by 9%

Twitter Q1 2022 results: revenue: $1.2B (up 16% y/y), net income: $513M (up 7.5x y/y), net margin: 43% (up ~6x y/y), global mDAUs: 229M (up ~16% y/y), US mDAUs: 39.6M (up 6.4% y/y)

Next week:

Airbnb (Tuesday)

Expected Q1 revenue: $1.452 billion +64%

Expected EPS: ($0.29) compared with ($1.95)

Lyft (Tuesday)

Expected Q1 revenue: $845.57 million +38.9%

Expected EPS: ($0.55) compared with ($1.31)

Uber (Wednesday)

Expected Q1 revenue: $6.088 billion +109%

Expected EPS: ($0.28) compared with ($0.06)

DoorDash (Thursday)

Expected Q1 revenue: $1.379 billion +28%

Expected EPS: ($0.42) compared with ($0.34)

Shopify (Thursday)

Expected Q1 revenue: $1.24 billion +26%

Expected EPS: ($0.51) compared with $9.94

📰 What’s going on

Airbnb CEO Brian Chesky Tweeted that staff can live and work from anywhere without compensation changes; workers can expect to come together for in-person sessions for about one week out of each quarter; the decision comes as other companies ask workers to return to office resulting in resignations

Google will now allow anyone to request removal of a broader set of personal information including phone numbers, emails, physical addresses, images of ID documents, and confidential login credentials

YouTube rolled out Super Thanks, its in-app tipping feature that includes animated GIFs alongside the fan’s comments, to all eligible creators across 68 locations in the YouTube Partner Program

WhatsApp is planning to launch cash-back rewards and merchant incentives to attract users in India to its P2P payments service

Instagram began testing a Templates feature, which allows users to copy formats from other Reels; it also started testing a feature that would let users pin multiple Feed posts to their profile, similar to how TikTok lets users pin videos

Meta will release a higher-end virtual-reality headset later this year that will focus on work-use cases; the wearable could eventually replace laptops and work setups, according to Mark Zuckerberg; the headset, codenamed Project Cambria, will have mixed reality capabilities to overlay the virtual world onto the real world, he said

Meta announced that it will open its first brick-and-mortar storefront; located at the company's Burlingame, California, campus, the store will sell metaverse-related hardware, including the company's Quest 2 headset, Portal, and Ray-Ban Stories; the store is expected to open on May 9

Meta AI said it's pursuing a long-term research project that will explore how the human brain processes text and speech to develop better AI language models; the initiative is a collaboration between Meta and neuroimaging laboratory NeuroSpin and Inria, the French National Institute for Research in Digital Science and Technology; the project could improve, for example, AI for tasks involving word anticipation, such as virtual assistants that can better predict the next word someone says in a sentence

Apple wrote to developers that it would be removing outdated appsfrom its App Store in 30 days if they were not updated; developers took to social media to express their unhappiness; an analysis of apps with at least 10,000 downloads in 2022 by Sensor Tower has discovered that 2,966 apps could be removed from the App Store

Apple launched its Self Service Repair store e-commerce website, where customers can buy spare parts and view manuals to repair their broken devices; currently, customers can order spare parts to fix their iPhone 12,13, and third-generation SE

Global consumer spending in apps saw relatively flat growth year-over-year during Q1; worldwide app revenue growth from in-app purchases, premium apps and subscriptions grew just 0.6% from $32.3B in Q1 2021 to $32.5B in Q1 2022; however, when looked at individually, the App Store and Google Play saw different trends; Google’s Play Store lack of growth pulled the combined growth rate down, as it saw approximately $10.7B in consumer spending, down 8.5% y/y from $11.7B in Q1 2021; meanwhile, Apple’s App Store revenue, which was double that of Google Play’s, grew 5.8% y/y from $20.6B to $21.8B

Snap launched its first flying drone camera, Pixy; the pocket sized device operates without a controller; it is available in the US and France for $230

Snap announced retailers will be able to integrate its AR try-on technology into their websites and apps; retailers will be able to add Snap's AR shopping lenses to their product pages, enabling customers to virtually try on their products; Snap says Puma is the first retailer that will get access to its technology

Spotify starting a Free and Open Source Software Fund (FOSS Fund); they will test the fund by giving away €100K in May; Spotify’s engineers will nominate projects and a committee will distribute funds to open source developers, partially influenced by Spotify’s dependencies

AWS announced the general availability of Amplify Studio, a virtual interface for front and backend development; Amplify Studio integrates with Figma, allowing designers and developers to collaborate on various tasks; new features added since the preview include support for UI event handlers, component theming, and improvements to customize generated elements with code; Amplify Studio builds the front end using React, View, Angular, or React Native.

Disney is ramping up its metaverse planning with a focus on blockchain technology over immersive mediums like VR; tangible products or solutions remain unclear

Twitter’s board accepted an offer from Elon Musk to buy the company and take it private, the company announced Monday; the cash deal at $54.20 per share is valued at around $44B; Elon Musk told banks that agreed to help fund his $44B Twitter acquisition that he could decrease costs by cutting executive and board pay; innovations around Tweet monetization was also discussed; Elon Musk sold roughly $8.5B worth of Tesla shares (5.6% of his stake) this week that could help him fund his purchase of Twitter

Telegram now supports crypto payments; the company previously gave up on its own token.; the addition could make crypto payments on messaging platforms more mainstream; the TON Foundation, which manages the toncoin token, has enabled fee-free payments—sending crypto to other users—using toncoin (TON) in the app; it also has added the ability to buy bitcoin within the app

The Central African Republic became the 2nd country to approve Bitcoin as legal tender after a unanimous decision by lawmakers; El Salvador was the 1st country to give crypto legal tender status in 2021

Robotaxi company Pony.ai secured the first-ever taxi license in China for 100 robotaxis; the startup will operate in the Nansha district of the city of Guangzhou; Pony.ai plans to launch in two other Chinese cities next year

📚 Good reads

Healthy teams. Great article by Hà Phan, highlighting some of the signals of a healthy team, and plenty of good advice

How do big tech giants make their billions? In 2021, the Big Five tech giants—Apple, Amazon, Google (Alphabet), Meta, and Microsoft—generated a combined $1.4T in revenue. What are the sources of this revenue, and how does it breakdown? Complement with this analysis by The Economist unveiling 3 big vulnerabilities of big tech: a high concentration of profits, waning customer loyalty and the sheer sums at risk from assorted antitrust actions

Create clarity: the one key job for Product Leaders. Suhel Mangera on why your key outcome is clarity, not fancy tools or processes

The TEA framework of productivity: managing your time, energy, and attention, by Anne-Laure Le Cunff

🔮 Emerging trends

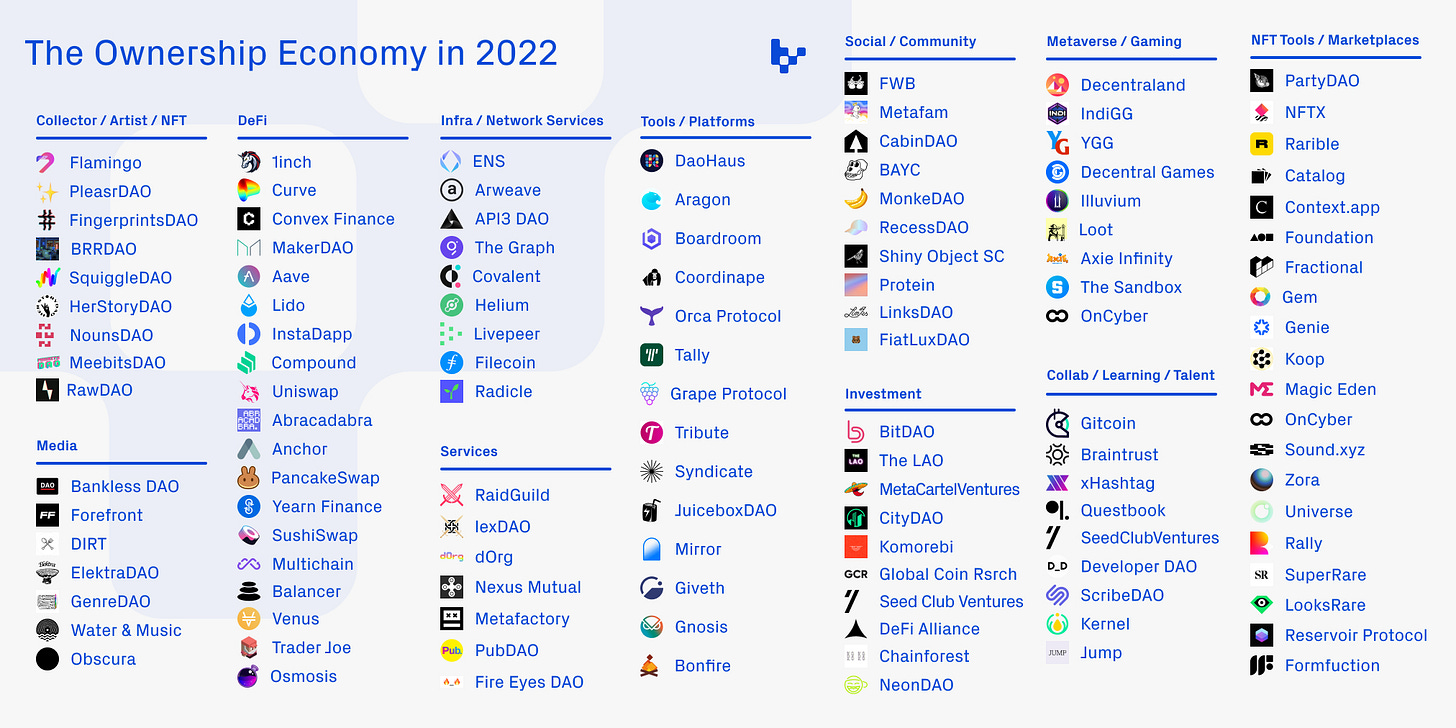

The Ownership Economy 2022: a primer on the state of web3. Good analysis of the web3 space and dynamics, which is gaining relevance really fast, and any PM should try understand to certain degree. “There are now more than 15,000 projects in the ownership economy, from user-owned financial markets to user-owned social networks, investment clubs, and digital assets. While the ownership economy still represents a small portion of all internet platforms, it’s a fast-growing segment”

Web3 Network Effects. Sangeet Paul Choudary writes about the mental models for Web3 and how network effects change in decentralized ecosystems

The metaverse is a vision, not a specific technology (Snap’s founder says Meta’s Metaverse is “hypothetical”). For enterprises, this ambiguity can make it challenging to figure out how to tap into the emerging trends the metaverse represents

Below, CB Insights provides a framework to navigate this evolving topic by breaking down the metaverse into distinct technological layers and highlighting the key vendors set on making the metaverse a reality

Have a great weekend!

Angel

el producto is free, but if you enjoy reading it, you can support my work and buy me a coffee 🙌

🇺🇦 Help Ukraine - I will re-direct 100% of el producto earnings from this and upcoming weeks to the UN Crisis Relief Fund for Ukraine. I am also offering 1-1 consultations with Product professionals affected by the conflict (whether need help finding a new job abroad, pivoting a product, etc)