el producto #252 🚀

Coinbase premium, Open source fintech, 2022 Product conferences, NFTs and the future of economy, Viral growth and network effects, Product discovery interviews & more

🎰 The week in figures

$2.4B: Paytm seeks to raise $2.4B at a $20B valuation with its IPO; investors last valued the company at $16B for a $1B round in November 2019; the Indian digital payments firm filed to go public in July and plans to launch its dual listing on India’s Bombay and National stock exchanges next week

$1.3B: Kakao Pay closes up 114% in its public debut in South Korea; the firm raised $1.3B and reached a ~$9.9B valuation with the offering; the company, which claims 36M users, plans to enter China, Europe, and Southeast Asia within five years

$1B: Cloud infrastructure firm HashiCorp files for IPO; the company could seek a $1B+ raise and a $10B+ valuation; investors valued the company at $5.1B for a $175M Series E last year; HashiCorp claims Adobe, Hulu, and Progressive as customers

$523M: Micro-mobility company Lime has raised $523M in convertible debt and term loan financing in preparation for an upcoming IPO in 2022. Lime's competitor, Bird, went public via SPAC earlier this year. Lime's CEO stated that the company is third-quarter EBITDA profitable.

$500M: Autonomous driving tech firm Momenta raises $500M Series C, bringing the round total to $1B+; the latest tranche included funding from Bosch, Toyota, and General Motors; SAIC plans to begin mass deliveries of the Zhiji L7 electric sedan, featuring Momenta's assistive driving tech, next year

$400M: Productivity platform ClickUp raises $400M Series C for a $4B post-money valuation; the software supports project management, goal tracking, collaborative document editing, chat, and more; the San Diego-based startup plans to establish a new headquarters in Ireland and to create 600 new jobs

$300M: Smart home platform Plume raises $300M for a $2.6B post-money valuation; investors valued the firm at $1.35B for a $270M round in February; Plume offers consumers and small businesses a cloud-based system for managing smart home devices and currently manages 1B devices around the world

$250M: HoneyBook, a financial and client experience management platform serving SMBs and freelancers, raises $250M Series E at a $2.4B valuation; offers project and task tracking, invoicing, branded templates for client communications, more

$234: Customer data platform Treasure Data raises $234M; the fully-managed big data service promises to unite teams and systems to ensure value-driven engagements; competitors include Leadspace, mParticle, and Segment

$215M: Biotech firm Immunai raises $215M Series B; the company uses machine learning to create high-resolution profiles of the human immune system to accelerate drug R&D and novel discoveries; for example, Immunai is working with the Baylor College of Medicine on cell therapies for neuroblastoma

$200M: When I Work, a scheduling and communications app for shift workers, raises $200M; the platform offers a drag-and-drop calendar interface for scheduling, with visual cues ensuring a manager has enough qualified and available workers for each shift; the startup claims 10M hourly workers representing 200k businesses

$150M: Hospitality management software firm Cloudbeds raises $150M; the San Diego-based startup serves hotels and motels, vacation rentals, bed & breakfasts, and other businesses; Cloudbeds plans to use the funding, in part, to establish a team to take the company public

$150M: Papa, which connects senior citizens with college students for companionship and help with daily activities, raises $150M Series D at a $1.4B valuation; “Papa Pals,” as they're called, help elders with meal preparation, trips to the doctor, etc; the Miami startup works with health plans and Medicaid plans

$150M: Chipper Cash a remittance/payment service for Sub-Saharan Africa, raises $150M Series C extension at a $2B valuation. Prior to the extension, Chipper raised $100M in a Series C led by SVB Capital six months ago. Chipper Cash partnered with Twitter to enable Tip Jar integration in Africa and plans on expanding the feature into the U.S. by next year

$124M: Payments firm Klarna to acquire price and product comparisons company Pricerunner for $124M (40% cash, the remainder in shares); Stockholm-based Klarna, which offers buy-now-pay-later solutions, will integrate Germany-based Pricerunner's product discovery, reviews system, and more into its app

$120M: Data management platform Reltio raises $120M at a $1.7B valuation; the cloud-native system unifies data from various sources, promising to enable enterprises to decrease costs and maximize revenue growth; clients include GE Healthcare and Xerox

$100M: Notable, which uses AI to digitize and automate healthcare processes, raises $100M Series B at a $600M valuation; the company provides APIs enabling healthcare firms to integrate tools that speed up administrative tasks such as updating patient notes and billing details, more

$95M: Fiverr acquires Stoke, a platform for managing freelancers and remote teams, for $95M; the software provides tools for onboarding, budget management, payments, and more; Stoke will continue to operate independently but will integrate its tools with Fiverr

$50M: Coinbase acquires AI-powered customer support platform Agara; sources indicated a price between $40M and $50M; Agara offers a no-code solution for integrating voice bots that automate many customer interactions

💸 Q3 financials

Uber ($86.15B market cap) Q3 mixed: $4.8B revenue, up 72% YoY ($4.4B expected); $8M adjusted EBITDA profit (the company's first); $12.8B gross delivery bookings, up 50%; $9.9B gross mobility bookings, up 67%; $2.4B net loss, largely attributable to investment holdings; -$1.28 EPS (-$0.33 expected)

📰 What’s going on

Meta to shut down the facial recognition feature it has used since 2010 to identify Facebook users in uploaded photos; the company said it would delete associated biometric data belonging to 1B-plus people; the feature spurred government investigations and a class-action suit

Alphabet announces Isomorphic Laboratories, a new subsidiary using AI for drug discovery; DeepMind CEO Demis Hassabis will also lead Isomorphic; the companies will remain separate, but they expect to collaborate; Isomorphic plans to build models to predict how the body will react to drugs

Coinbase begins testing a premium subscription service called Coinbase One; the service reportedly gives users fee-free trading and priority support; a screenshot included in materials viewed by The Block indicated an option for increased account security

Cruise begins driverless robo-taxi trips in San Francisco, currently limited to company employees and select, non-paying members of the general public; the company's permit restricts driverless rides to 10 pm to 6 am, and a maximum speed of 30 mph

Walmart to acquire tech assets from Botmock, which enables the rapid prototyping of conversational apps; terms undisclosed; the Ottawa-based startup offers a no-code, drag-and-drop interface for creating AI-powered bot features and an API for integrations

Zillow shuts down its home-flipping business, Zillow Offers, after halting home purchases for the rest of the year; the company said its algorithmic model for buying and selling homes failed to predict appreciation correctly; the company also said it would cut 25% of its workforce, or ~2k people

Tesla launches a home charger that supports non-Tesla EVs; the $415 J1772, a Level 2 wall charger, supports indoor and outdoor installations and charges at up to 9.6kW; the company also launched support for non-Tesla EVs at Supercharger stations in the Netherlands

Tencent announces a cloud operating system called Orca and three chips in development: AI chip Zixiao, video processing chip Canghai, and high-performance networking chip Xuanling; Alibaba and Xiaomi also announced custom-designed chips this year

📚 Good reads

2022 Product Conferences. Teresa Torres has published her yearly list of Product Conferences. Lots of them keeping the free and virtual formats, but also several new events around the world

Why the best way to drive viral growth to increase retention and engagement. If you can only read 1 article this weekend, make it this one. Andre Chen explains what are the best Network effect unlockers, and how viral features that are “native” to the product (and not “one-way” referrals), can drive both engagement and exponential growth

Product discovery interviews, a guide and framework for effectively talking to users by Kyle Evans. Including a useful template to help you prepare discovery interviews

Universal holdout groups and A/B testing at Disney Streaming. A universal holdout group aims to hold back a randomly-sampled small % of users from all product changes for a period of time. This allows to determine the cumulative, long-term impact of product changes and multiple A/B tests overtime

Open source and the future of fintech, by Angela Strange. Until very recently, financial services were notoriously hard and expensive to build. Imagine, instead, that financial services were built with software building blocks like Lego. These blocks could be assembled flexibly to allow for hundreds of different use cases. “Financial services used to be confined to banks, but now any company has the capability to add fintech“

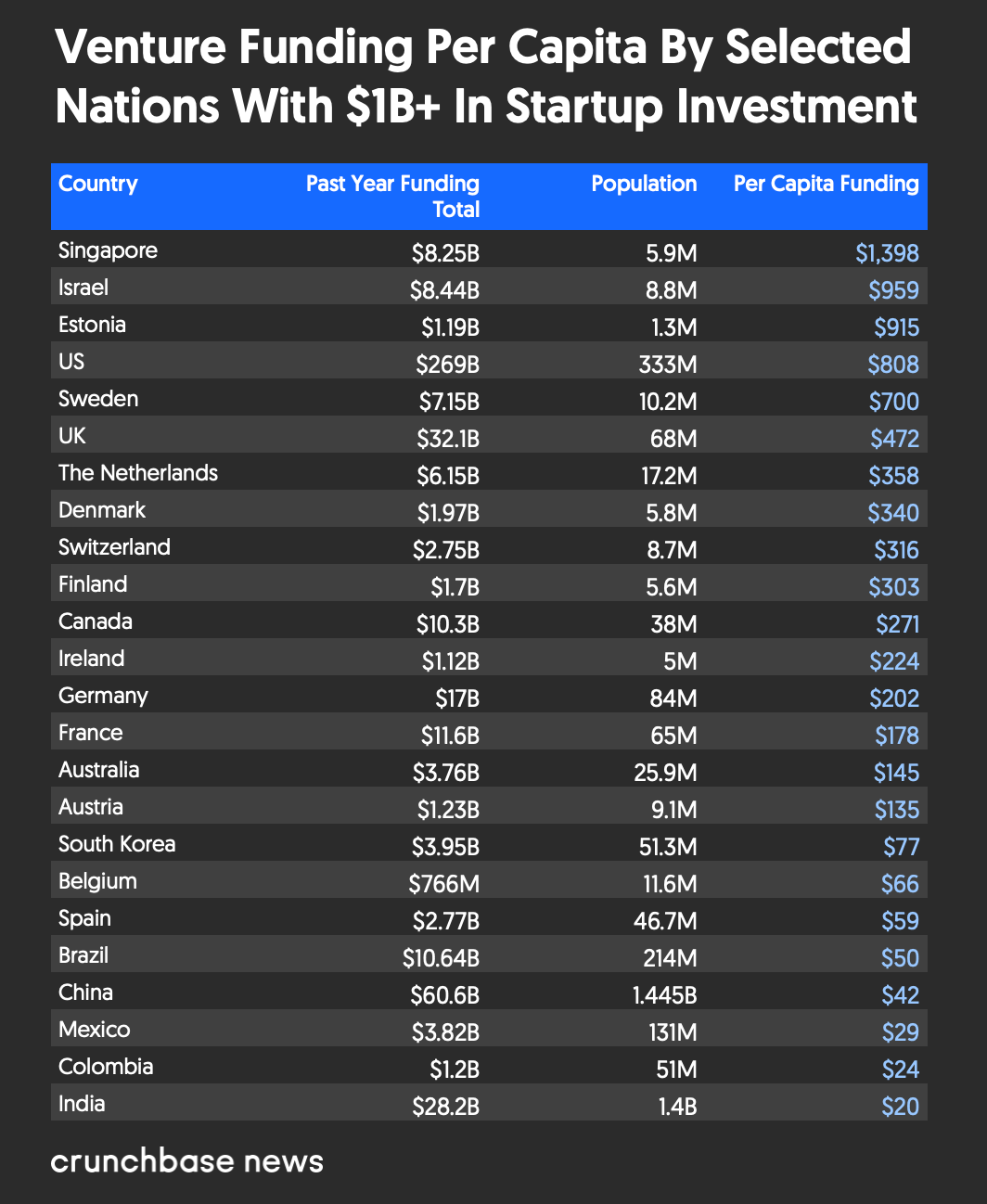

Countries with the most VC investment per capita. Interesting report by Crunchbase showing the world’s startup powerhouses

[Podcast] Tim Ferris talks to Chris Dixon and Naval Ravikant on the wonders of Web3, how to pick the right hill to climb, finding the fight amount of crypto regulation, and the untapped potential of NFTs

Have a great weekend

Angel

el producto is a free service, but if you enjoy reading it, you can support my work and buy me a coffee 🙌